29th Jun 2022

To generate employment opportunities in rural and urban areas of the country through setting up of new selfemployment projects / micro enterprises in

Read More..

29th Jun 2022

To facilitate technology to MSEs through institutional finance for induction of well established and proven technologies in the specific and approved ...

Read More..

29th Jun 2022

Encouraging both manufacturing and service enterprises to increase productivity and provide incentives to MSMEs for onboarding on GST platform which ...

Read More..

29th Jun 2022

The Credit Guarantee Scheme for Micro and Small Enterprises (CGS) was launched by the Government of India (GoI) to make available collateral-free cred...

Read More..

29th Jun 2022

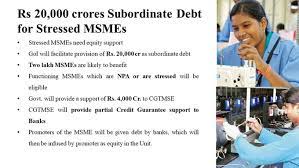

Subordinate debt will provide a substantial help in sustaining and reviving the MSMEs which have either become NPA or are on the brink of becoming NPA

Read More..

29th Jun 2022

Raw Material Assistance Scheme aims at helping MSMEs by way of financing the purchase of Raw Material (Both indigenous & imported). This gives an oppo...

Read More..

16th Aug 2022

To meet the credit requirements of MSME units, NSIC has entered into a Memorandum of Understanding with various Nationalized and Private Sector Banks....

Read More..