Hospitality MSMEs, others urge govt for interest waiver, moratorium extension, employee salaries, more

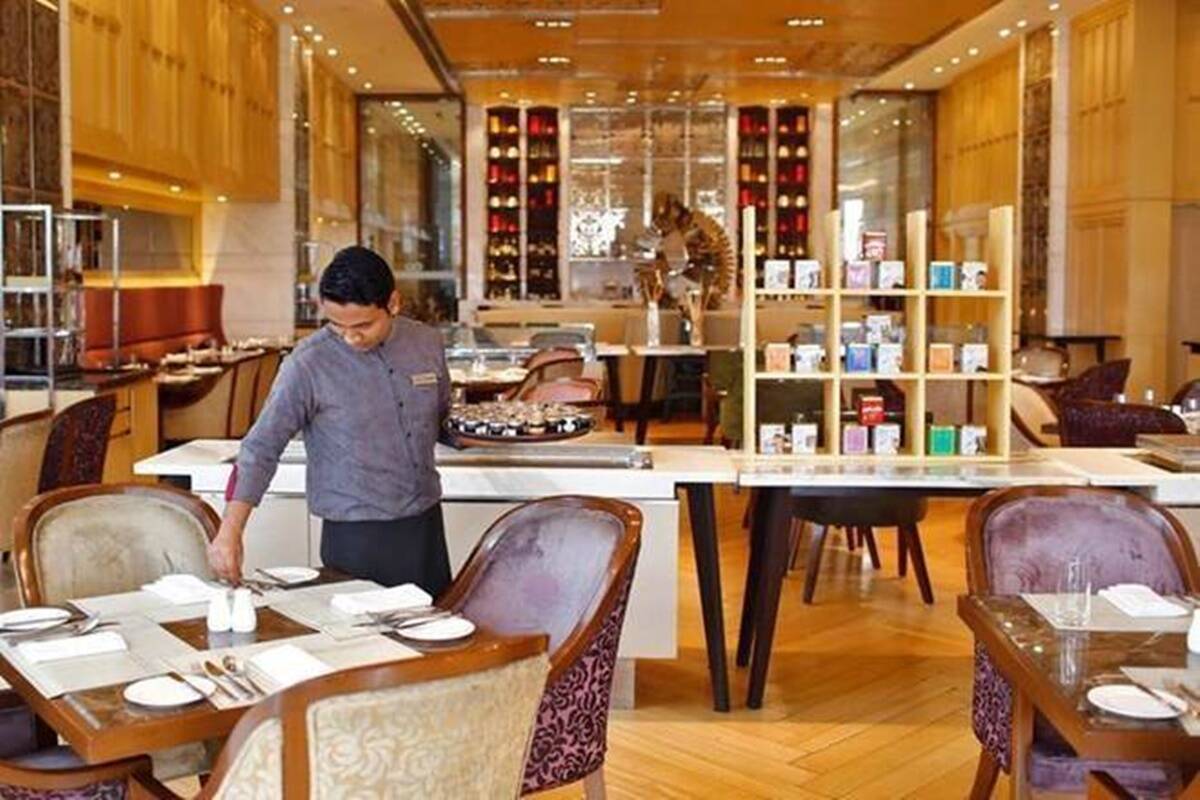

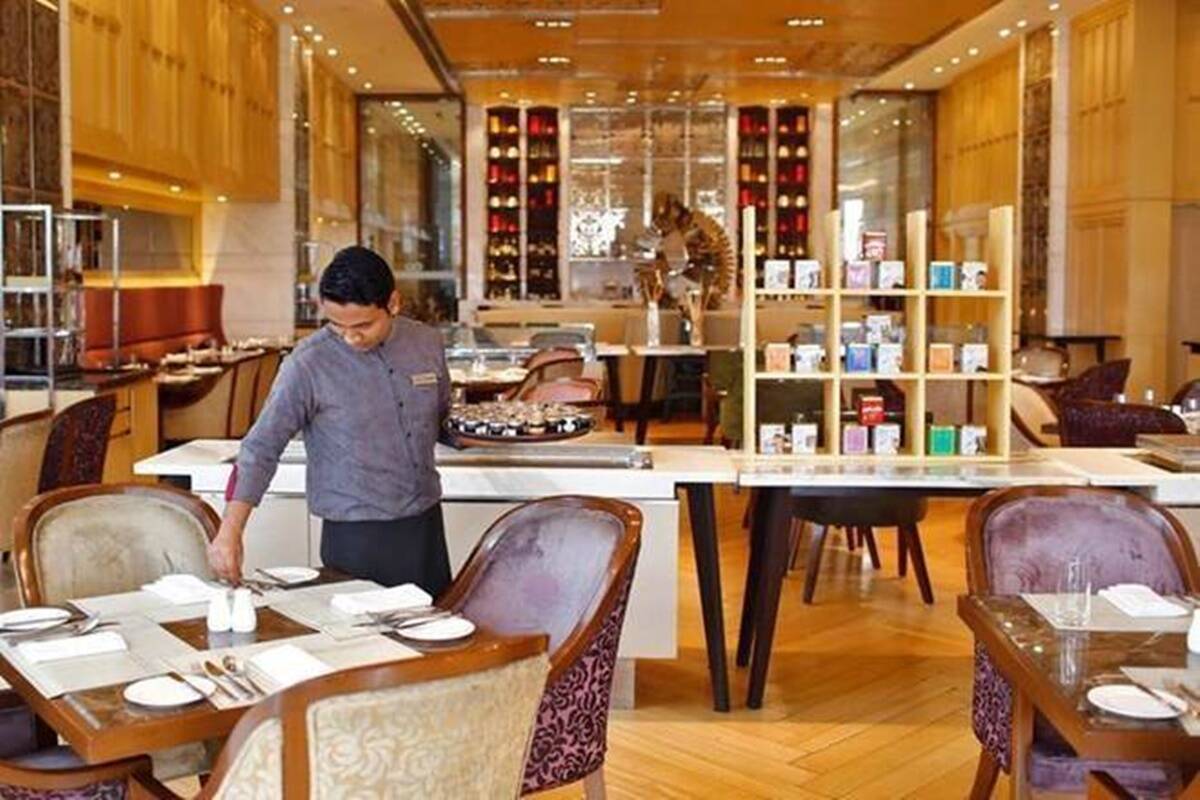

The government had announced ECLGS 3.0 in April this year to cover enterprises in the hospitality, travel & tourism, leisure & sporting sectors. Nearly a week after the Reserve Bank of India had announced separate liquidity support of Rs 15,000 crore with tenure up to three years for the contact-intensive sectors such as hospitality and ancillary services till March 31, 2022, the industry has now reached out to the Tourism Minister Prahlad Singh Patel and MSME Minister Nitin Gadkari to recommend “immediate fiscal measures to save it from imminent collapse,” the apex hospitality association Federation of Hotel & Restaurant Associations of India (FHRAI) said on Wednesday. “Hotels’ recovery would take at least three years after everything gets back to normal and travel is fully allowed. It would be juvenile to think about recovery in the coming few months of unlock to reach the pre-Covid levels. Even if people start eating out and travel, it would not compensate for the 1.5 years of closure. Restaurants will take 1.5 years to recover if there are no restrictions and no social distancing norms. The sector has a large portion of MSMEs,” Gurbaxish Singh Kohli, Vice President, FHRAI told Financial Express Online.

In a representation submitted on Tuesday, FHRAI has asked for a sector-specific stimulus package including complete waiver of interest on loans, extension on a moratorium of three years on the principal amount for all loans, and monthly basic salaries to employees of hotels and restaurants who lost their jobs amid pandemic. Among other key asks were expediting payments due towards the sector under Service Exports from India Scheme (SEIS) and IT refund, waiver of secondary condition on average foreign exchange earnings Under Export Promotion Capital Goods (EPCG) Scheme and treating payment from foreign tourists in INR as forex earning, bringing the tenor of ECLGS 1.0 and 2.0 at par with the tenor of ECLGS 3.0, and lastly, removing Rs 50 crore cap Under the special restructuring window and the condition requiring accounts classified as standard as of March 31, 2021.

“We still welcome the RBI’s liquidity support them but we want further clarity on the support. We want the government to pay basic pay to employees. We have not received any money back under the SEIS scheme. The least they (the government) could do at a time like this is to give that money to help businesses with cash flows. You cannot prepare the industry for losses due to the pandemic. You can only prepare for the protocols required to fight it. If there is a third wave, there would be more shutdowns and job losses,” added Kohli.

The hotel and restaurant sector’s total revenue in FY20 was Rs 1.82 lakh crore of which around 75 per cent as per FHRAI estimates was wiped off in FY21. This is over Rs 1.30 lakh crore revenue hit for the Indian economy. The total loan outstanding to the hospitality industry was more than Rs 60,000 crore currently, the body added. Due to financial losses, 40 per cent of hotels and restaurants in the country have shut down permanently and around 20 per cent haven’t opened fully since the first lockdown while the remaining 40 per cent continue to run in losses, it added. The government had in April this year announced ECLGS 3.0 to cover enterprises in hospitality, travel & tourism, leisure & sporting sectors and extended the overall emergency credit scheme including the previous two versions by three months from March 31, 2021, till June 30, 2021, or until guarantees for the entire Rs 3 lakh crore amount are issued. The scheme was later extended till September 2021.

“The (ECLGS) funds available are not substantial. It has come too late as there is hardly any money left but one should wait for detailed guidelines. However, it makes for a good deal at least for people to repay loans after two years as they can make barely any money to repay currently,” Pradeep Shetty, Director, Maharaja Foods & Restaurants and Joint Secretary, FHRAI had told Financial Express Online.

Lenders under ECLGS have already disbursed Rs 2.54 lakh crore to MSMEs of the Rs-3-lakh-crore ceiling, Sunil Mehta, Chief Executive Officer, Indian Banks’ Association (IBA) had told reporters on May 30 in a virtual press conference on the extension of the ECLGS scheme.